If you pull at the chin you will find its just another mask covering a lack of corporate regulation and taxation.

Exactly. Just look at who controls almost all food production. It’s just a few huge corporations. Even if they don’t collude (and I’m in no way claiming they don’t), it’s easy to avoid competition, if there’s just a few participants in the market.

How hard is it to buy real food, not some processed garbage…

Pretty hard, depending on where you live and what your socioeconomic circumstances are.

This last weekend my sister went to the farmers market and I asked how is that maybe I should check it out. She replied expensive and she can only pick up a few things she really likes. My wife and I years ago used to get parsnips as a healthier potatoe but it got to expensive. Of course your going to have the crowd that is like. Just eat rice and beans all the time (although make sure to get white rice and clean it really well to get the arsenic out)

It’s laughable when some people talk about inflation as it’s a physical law like gravity. No, it’s a decision of the capital owners to protect and grow their profits at the expense of the workers.

This is a phenomenon that’s literally thousands of years old. It’s just basic economics. If there was good competition, there wouldn’t be any price gauging. And that’s the regulator’s fault not the company’s. Americans want their free market, they get their free market. So stop complaining.

The market is anything but free when the price to entry is so high and the big wigs get bailed out constantly. Yes, I agree that farmers should be subsidized, but if we do that, we do not have a “free market” and we shouldn’t.

Sure, in the broad, capitalist sense, you can’t blame the company.

But, as just a collection of people, you can absolutely blame them. Saying that a company has no fault in deciding to use aggressive, manipulative methods to pull money out of people no matter what feels on the level of saying 'I couldn’t help myself, they should’ve stopped me from being terrible".

Or "she was asking for it, just look what she’s wearing’

Inflation and our financial system were created by politicians.

Yup, it’s just bullshit like trickle down economics.

The only people being affected by inflation are the people who can’t afford to save money. (Which one of the points of inflation is to prevent money hording)

The oligarchy hides most of their wealth in owning stuff and as such are unaffected.

Corporate greed is definitely a factor. But that can only run rampant without strong competition. And it’s the job of antitrust enforcement to make sure there is competition. Which they have been failing miserably at for decades.

To toot the anticapitalist horn, antitrust and regulations and anything such is fundamentally in opposition to our economic system. We’re constantly fighting the system, just to get a liveable life. We fought just to get 8 hours a week and some economists in the 19th century and early 20th century imagined we right now would be having 15 hour work weeks. Guess why we don’t do 15 hours a week. Because the economic system, capitalism, benefits more the more we work. Capitalism would love to take us back to 12 hour days 6 days a week. Actually capitalism would want us working every single waking hour and also in our sleep if we could be productive in our sleep.

This is why I’m a socialist, because I don’t see why we maintain a system we need to keep fighting with when we could work on replacing it with a better system that et don’t need to fight with.

In support of OP, just copying and pasting a comment I made a few days ago for the benefit of anyone who doesn’t think this is real or widespread.

The gig has been up about their “supply chain costs” excuse they started pulling during the pandemic for quite some time now.

Federal Trade Commission (FTC) Chair Lina Khan is pushing for an inquiry into the ongoing surge in grocery prices that started during the Covid-19 pandemic and that remains a hot topic in this year’s presidential election.

On Thursday, during a virtual public meeting hosted by the FTC and the Department of Justice, Khan said the probe would “shed light” on why prices and profits at grocery chains “remain so high even as costs appear to have come down.”

“We want to make sure that major businesses are not exploiting their power to inflate prices for American families at the grocery store,” she said.

Puh. They absolutely ARE and HAVE BEEN exploiting their power to inflate prices.

Between grocery prices, fast food shenanigans, and shrinkflation, anyone with little enough disposable income to be at all conscious of prices has known for a long while that these companies have picked the pandemic as their excuse to pull in as much money hand over fist as they possibly can, all while fighting tooth and nail against wage increases to even approach the overall rate of inflation across the same period of time.

From the first link in that para:

TheStreet reported that Medium French Fries went from $1.79 in 2019 to $4.19 in 2024, a 134.1 percent increase. A McChicken went from $1.29 to $3.89, a 201.6 percent hike.

The price of the beloved Big Mac increased 87.7 percent, from $3.99 to $7.49. An order of 10 McNuggets rose by 68.8 percent, from $4.49 to $7.58. Of the five popular products examined, cheeseburgers saw the largest price increase—going from $1 to $3.15, a 215 percent spike.

These increases exceed the general average for inflation calculated by the Bureau of Labor Statistics, which shows that prices went up by about 21.5 percent between the end of 2019 and March 2024.

From the second link in that para:

Few details were released about the change, but Wendy’s CEO Kirk Tanner said the new menus will let the fast food chain test “more enhanced features like dynamic pricing and day-part offerings along with AI-enabled menu changes and suggestive selling.”

“We expect our digital menu boards will drive immediate benefits to order accuracy, improve crew experience and sales growth from upselling and consistent merchandising execution,” Tanner said on the call.

Surge pricing could be a “turning point” in the industry, according to Jonathan Maze, editor-in-chief of trade publication Restaurant Business. “If Wendy’s idea works, it could get others to do something similar, and I wouldn’t be surprised to see another chain or two test the idea themselves, given what Wendy’s is doing.”

Fuck you Wendy’s. You’ve been a favorite since I was 12, and I tried to ignore your decreasing quality in recent years. You are dead to me now. (Yes, I know they rolled the idea back after they heard what the announcement did to the pitchfork futures market.)

From the third link in that para:

Frito-Lay shrank bags of some of its Dorito’s from 9.75 ounces to 9.25 ounces. Bags in both of these sizes, as well as some 9.5-ounce bags, are currently for sale at Target for the same price. "We took just a little bit out of the bag so we can give you the same price and you can keep enjoying your chips," a Frito-Lay spokesperson told Quartz.

Fuck you Frito-Lay, what kind of Orwellian doublethink is this?

Surge pricing is such a fucked up term. How about lunch/dinner time price gouging? That’s what this is.

Oh people buy fast food for lunch and/or dinner? Then that’s when we’ll raise the prices! Nothing fucked up to see here folks!

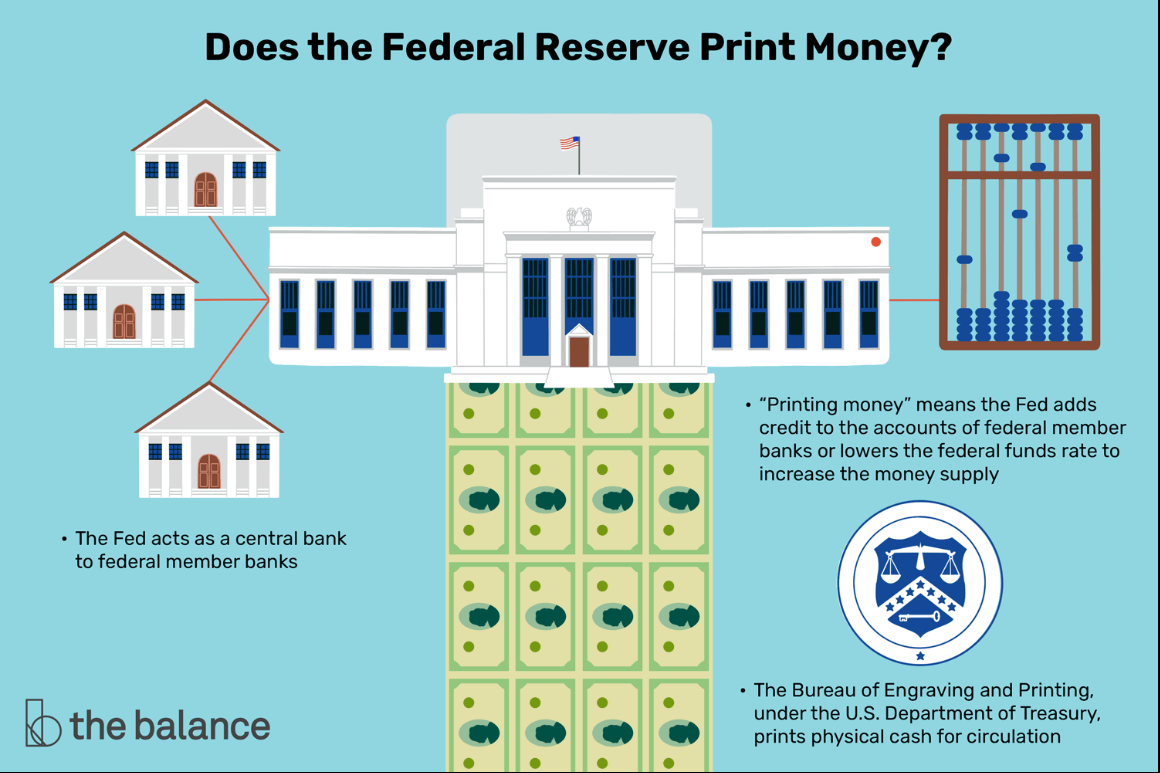

I think the bigger issue is the Federal Reserve.

Not really. Not with the COVID inflation. Over the last few decades sure. But rent and food doubling was corporate greed. We have them on their investor calls bragging about it.

It seems there’s plenty of culpability to go around.

True, it goes back to what you are following.

It reminds me of:

“You follow drugs, you get drug addicts and drug dealers. But you start to follow the money, and you don’t know where the fuck it’s gonna take you.”–Det. Lester Freamon

Absolutely! Thanks for the giggle, dear friend.

I don’t think the federal reserve is active outside the US. Also printing money was the cause of inflation when gold was backing the money, now the worth of money is only governed by what you can buy with it. Like you can double the amount in circulation but if no one raises prices there would be no inflation.

FED policies affect every currency on this planet as they are all backed by the usd… the consumer price index was designed to under report inflation. The basket would be CHEAPER every year because of improvements in production if there was no inflation.

There are a handful of currencies backed by USD but most are not. I only know of Belize dollar, the Hong Kong dollar and the Dirham as backed by USD, as far as I know those are the only ones.

Do you think stores look at the inflation and raise their prices accordingly or do they raise their prices and inflation is calculated based on that? One of those is correct.

Stores don’t look at inflation, inflation makes the stuff they sell more expensive to buy, so they have to sell it for more money or make losses.

Fed policies like interest rates directly affect almost all countries because they have USD debt.

Stores don’t look at inflation, inflation makes the stuff they sell more expensive to buy, so they have to sell it for more money or make losses.

Oh wow, stores must suddenly be buying their materials much cheaper recently when they realized they need to charge less, right?

Or did they just realize the market won’t bear what they’re charging, so they’re lowing their prices to get more business and lower the margin on their sales?

Hint, it’s the second one. Because stores are raising prices to increase profits, not to make up for increased ingredient costs.

Go look up net profit margins of retailers, they are going sideways.

Thats because of how they define profits.

Every company wants ALL the money.

They make enough to pay all their bills and expand reasonably.

They are not happy with that.

Its always more more more.

And yet they can afford to advertise they’re dropping their prices 🤔

So what makes the stuff stores buy more expensive? Like you can create a chain of price raising as far as you want but ultimately it’s just someone deciding to raise prices and that creating inflation.

Again, only a handful of countries own US debt and I don’t even know how US debt interest rates are going to connect to inflation in other countries. Like China and Japan are the largest debt holders and their inflation is vastly different.

Nobody said US debt, it’s USD debt, this is basic international economics knowledge.

Inflation is the loss of purchasing power of money, not somebody raising prices. Inflating the money supply leads to loss of purchasing power.

Inflating money only loses purchasing power if it’s tied to the value of something else as I originally said. That was literally my original point.

And what do you mean by USD debt?

Bermudian dollar as well

you can double the amount in circulation but if no one raises prices there would be no inflation.

Let’s say all dollars are now worth 2 Xollars. Trading in dollars is now illegal and everything must now be traded in Xollers.

A loaf of bread costing 1 dollar will now cost 2 Xollars.

Doubling the amount of money in circulation doubles prices.

I think the bigger issue is the Federal Reserve

And you would be wrong and using a far right talking point.

The federal reserve has no say on how much corporations charge for their goods and what they consider acceptable profit margins.

An oversupply of money CAN cause a certain amount of inflation, but it’s almost nothing compared to corporate profiteering.

lol. The Fed devalues your money, of course that leads to rising prices.

Nowhere near as much as price gouging does. The people selling wares decide the price of them regardless of the money supply, which is mostly meaningless in a predominantly digital economy.

The fed affects the interest rate, which has an indirect effect on prices, but the ones actually deciding what to charge for food, rent, or utilities are the final arbiters artificially increasing prices higher than they need to in order to maximize profits.

Which company do you think is price gouging?

Just off the top of my head, some major ones are Walmart, Tyson, Perdue, At&T, Verizon, PG&E and there’s many, many more.

Go look up their net profit margins, they are going sideways.

Yeah, those numbers are what’s left AFTER they’ve done a bunch of creative accounting to avoid taxes.

Their ACTUAL profit margins are significantly larger and growing.

The fed does have a say in doubling the money supply. That’s the real source of inflation.

That’s a St Louis Fed overview of savings accounts 🤦

Get out of here with that bullshit

Way to factual for a shitpost.

Yeah, you would, wouldn’t you.

Can’t zoom in on an animated GIF. There’s no reason for that to be animated.

Here ya go:

I had my economics teacher tell me that it’s not grocery stores fault because they just need to make a profit 🥺

I had another teacher tell me that raising minimum wage would cause inflation to go up… as if people aren’t literally starving in the streets right now

I don’t understand why teachers making 0.0006771% of Jeff Bezos’s salary care so much about them

I watched Richard Wolff explain that they didn’t teach him Engels at Harvard. He had to study him at a Catholic school.

It’s so hard to get people (MAGAs especially) to understand that this is being done to us. It’s not Biden’s policies but corporate greed, you can’t have record profits and blame inflation for rising prices and stagnant wages.

It is inflation. And “greed” is accounted for in the definition of a market. Oligopolies are not.

Sorry, but it is mainly Biden’s policies. The administration has largely ignored white collar crime, especially when it comes to things like price collusion, antitrust, etc.

Case in point: the DOJ lawsuit against RealPage software (which landlords were using to collude on apartment prices). The company was engaged in extremely serious criminal activity, but the DOJ did not file any criminal charges.

We’ve had six straight administrations of almost total non-enforcement of antitrust. I’m happy with Biden bringing lots civil cases when no one else has done anything about the problem, especially because civil cases are much easier to win. The goal should be to fix the problem more than punish people for what past administrations effectively legalized.

A lot of things don’t even go up at the inflation rate. Look at the car prices and housing.

Car prices: supply is constrained because of supply chain issues where often just a small handful of the myriad of chips in the car are unavailable.

Housing: supply is artificially constrained by various laws, often of the NIMBY type.

It’s not just constraints, IT’S FUCKERY. https://www.dailykos.com/stories/2024/6/5/2244971/-FBI-raid-on-real-estate-company-linked-to-Harlan-Crow-s-RealPage-rental-price-fixing

There is that, but the larger explosion in housing prices can be largely chalked up to under supply in popular markets.

Inflation is an average of a number of expenses, so that’s always going to be the case.

Fucking raise the minimum wage. The problem is that prices are rising but wages are remaining stagnant.

Minimum wage should have been tied automatically to inflation rates. Even if it gets increased, 30 years from now we’ll be in the exact same boat.

Solid take.

Now, if they’d be honest about inflation rates…

Yeah, the actual calculation still needs to be done right, but having it as an ‘automated’ process will help reduce this sort of bullshit:

Agreed.

Without a way too keep them from just raising costs to match, raising min wage has a limited effect. Taxes on profit are more effective. Reinvestment or raises should be deductable, tax the everliving fuck out of gross profit for the rest.

The area I lived in voted for a minimum wage increase several years ago. Tons of people were saying that it was a bad idea, because the businesses would just raise prices on everything.

Minimum wage increase passed. Prices didn’t change.

I think this is because minimum wage increases don’t happen in a vacuum. There are other things to consider. If your company raises prices, I’m going to go to a competitor who doesn’t. The idea that “they’ll just raise prices” assumes that all businesses will react to a minimum wage increase in the same way, and that’s not the case.

Perhaps I was being overly cynical but last years grocery hike was all of those businesses acting in concert. Which I’m sure is illegal for everyone but the rich…

Always has been. Saying “I-its not inflation! It’s… corporate greed!” was always a political decision and nothing more

did you mean for the quote to be the other way around?

No? The inflation of the past few years was way too apparent for the current administration to ignore in their reelection campaign, but “inflation” is a scary word with some serious political connotations that no sitting official wants to connect themselves to. Instead, you just say “it’s not inflation, It’s corporate greed!” and you’re saying the same thing twice.

See how “Depression” became “Recession” which became “Economic Downturn”

depression didn’t become recession, they’re different severities of economy downturn, which is a more generic term. nothing replaced anything.

recessions are more common and last anywhere from a couple of months to about a year or two. depressions are rare and last longer, and the effects on things like unemployment and GDP are more severe. the great depression lasted 10 years.

the difference between recession vs depression is akin to hill vs mountain. a steep hill can make you cite your entire swearword vocabulary on the way up, but a mountain will make you wear special equipment, need external support, and wish it was just a hill. where the line lies is probably arbitrary, but that doesn’t mean every hill is a euphemism for mountain.

economic downturn in this analogy is akin to “elevated ground”. it’s generic and can be anything from an anthill to a mountain.

This meme is propaganda. The primary cause of inflation is out of control government spending. In the wise words of Milton Friedman, “Every budget is balanced… If you want to know the real government budget look at inflation.”

The primary cause of inflation is a massive increase in the money supply

Sure. The 20% inflation since 2020 is why food prices have doubled.

Money supply has gone from 15.5 to 21 = +35% over the same period

My understanding is that the government wants to reduce the value of the dollar so their massive debt has less value

Yes.

Printers go brrrr