Good. Shut that shit down

I personally find it incredibly useful, but I agree that it should be regulated. It is very obvious that the way these systems work currently is not in the interest of the citizens, judging by the numbers of people who go into a debt spiral they cannot resolve. Just because it’s useful for my case doesn’t mean that it should stay as it is.

Providing easier access to credit encourages higher prices. It also has a negative effect on the less money-minded person, who then never learns the concept of saving. It also reinforces the “now now now” concept of consumerism.

The only thing my crappy mother actually taught me, through her own credit card debt, was that if I don’t have the cash, I don’t get the thing. Easier said than done, I know.

I don’t disagree with your comment in any way. It’s a complex situation, and there are positives and negatives to doing it this way.

Out of interest, how do you use it that you find it useful?

Sure! I use it “as intended”. I pay later. But I only use it when I know that there’s going to be money later (I have money now) and I plan my economy pretty thoroughly. It gives me some extra space when I need it, and makes it so I don’t have to put out my own money to companies I haven’t purchased from before, which can be useful since I tend to look for the best deal available and that often leads me to smaller shops that have no ratings or other reputation online.

Is there an advantage to buying from unknown shops via Klarna as opposed to paying directly? Does Klarna deal with any dispute or do they demand the money from you anyway?

I have found that its easier to get refunded because you haven’t paid yet and Klara has more power to get a refund

This

I can get the product in my hands before paying for it, so I can verify it’s what I wanted. I also don’t spread my debit card info around.

Assuming it’s not what you wanted, does Klarna deal with the seller in case of a dispute or are you stuck dealing with the seller while still having to pay Klarna?

I simply don’t pay the invoice and send the product back. I never fronted any money.

While I agree that increasing consumer debt is a problem, I think Klarna provides a valuable service for online shopping.

I can get my goods delivered and inspect them before paying anything. If the goods are not as stated (or don’t arrive at all) I just dispute it and then it is Klarnas problem, I haven’t risked anything of my own money. If I had paid up front, I would have to try to get my money back. It’s almost always harder to get money back than to dispute and refuse to pay.

Some regulations are welcome, but I don’t see BNPL as a bad concept in itself.

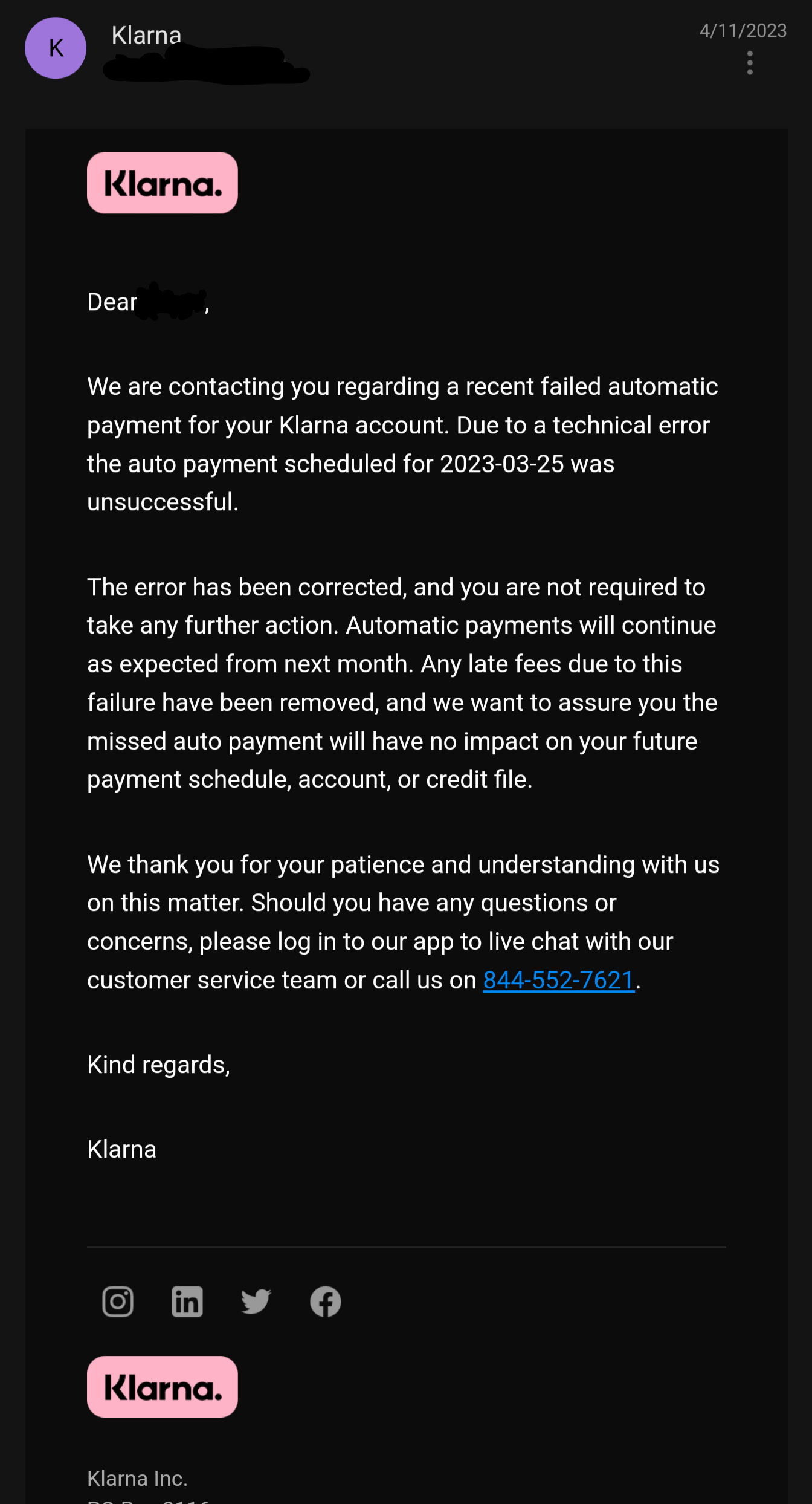

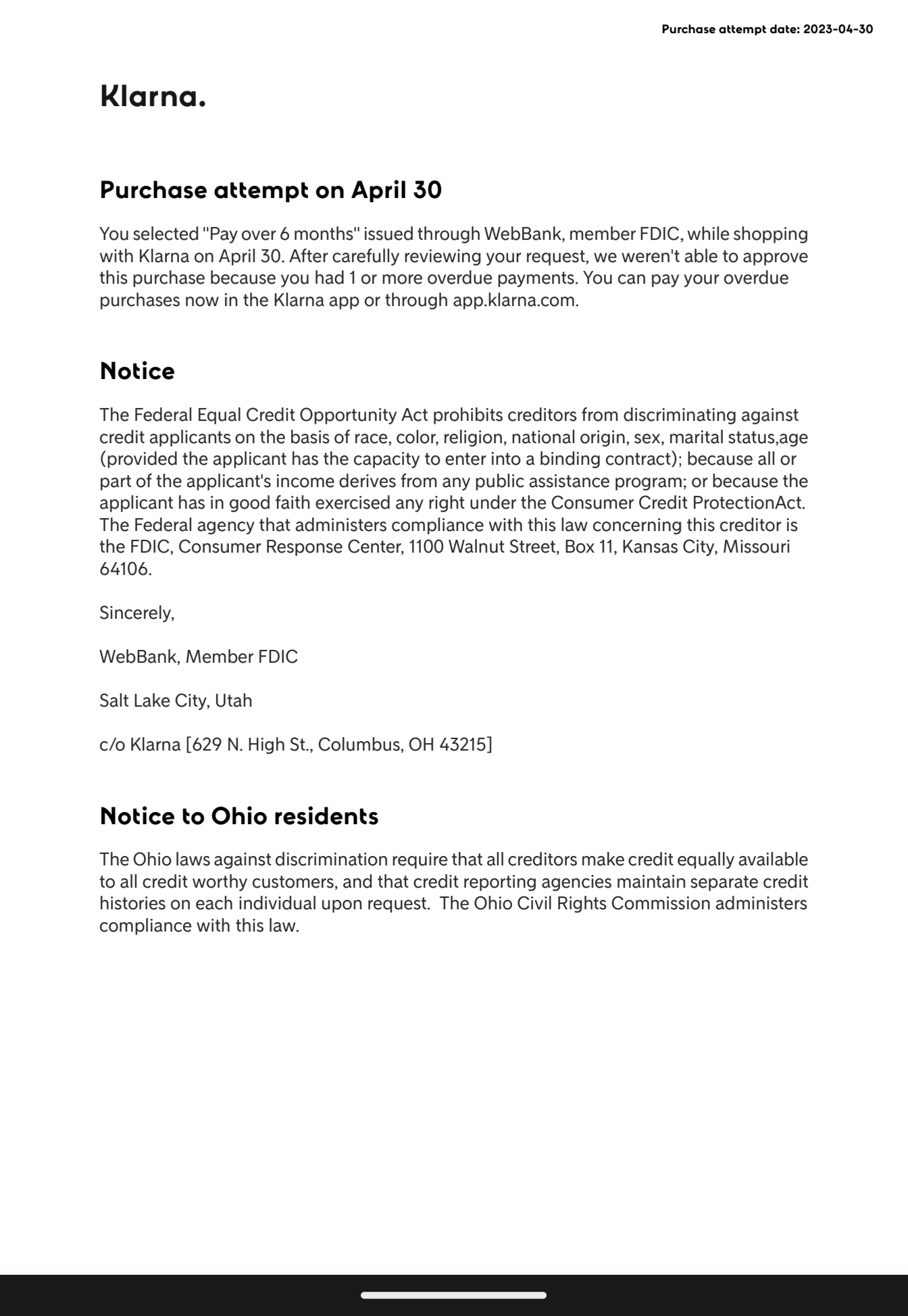

Klarna is permanently on my do not trust list, as what I experienced told me they can’t manage their system correctly. And for someone who can put a derogatory mark on your credit, I’m not risking it.

(Bear in mind when I got the first email, just to be safe, I paid off the remaining balance the Friday of that week.)

I figured they caught and corrected it, so no harm, no foul.

When I tried using them at the end of the month however, (I think for upgrading my comp) they rejected my finance request. I wasn’t sure, but I had my suspicions it was due to their fuck-up as I only used them once.

3 weeks later, they sent this.

It’s the people they’re counting on not paying after the BNPL period is over that need more protection. That’s where the trap is, and where these actors make their money.

You can already do all that with a credit card, and your bank is more likely to side with you. Why not just use that? There’s several decades more regulation on credit cards, too.

Mostly convenience, the Klarna app is miles ahead of what my bank offers.

That’s not even true. Oftentimes, the debit card transaction is completed long before the product arrives…

You should never use a debit card, at least in the US. Always use a credit card.

Debit cards are defacto standard in the EU, far fewer uses credit cards.

BNPL encourages higher prices.

Too many people end up in debt spirals with these BNPL companies because there’s no consistent safeguards against it, so we absolutely should be regulating them better. We shouldn’t be leaving financially vulnerable people to the wolves.

It’s way too easy to use these companies, so often klana comes up as an option as if it’s a payment method. There should be hoops to jump through before you can use these companies

These things need regulation. It is insane to finance a pizza.

CNBC - News Source Context (Click to view Full Report)

Information for CNBC:

MBFC: Left-Center - Credibility: High - Factual Reporting: Mostly Factual - United States of America

Wikipedia about this sourceSearch topics on Ground.News

https://www.cnbc.com/2024/07/25/bnpl-britain-plans-new-regulations-after-setbacks.html